washington state capital gains tax 2020

Washington Capital Gains Tax to Fund Education Initiative 2020 The Washington Capital Gains Tax to Fund Education Initiative was not on the ballot in Washington as an. Up to 15 cash back Wondering about Washington state Capitol gains tax our house we purchased the home November 2020 for 397000 and - Answered by a verified Tax.

Public Records Reveal Wa Dor S Thoughts On Capital Gains Income Taxes Washington State Wire

There are several deductions and exemptions available that may reduce the taxable amount of long-term gains including an.

. Experienced in-house construction and development managers. Compare 2022s Most Recommended Tax Relief Companies that Can Help You End Your problem. The new tax is assessed at a rate of seven percent on an individuals Washington capital gains.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. The washington state capital gains tax start date collected from this tax will fund the education legacy trust account and common school construction account. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

The tax only applies to gains allocated to Washington state. The tax would equal 9 percent of your washington capital gains. Ad Do Your 2020 2019 2018 2017 all the way back to 2000 Easy Fast Secure Free To Try.

However real estate retirement savings livestock and timber are exempt from this tax. Experienced in-house construction and development managers. Ad Compare the Best Tax Relief Companies Get Expert Help With Your IRS Payment Issues.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. The Center Square Washington Democrats passed the first capital gains tax to ever survive the floor of the state Senate in a narrow vote Saturday. Ad Instantly Download and Print All of the Required Real Estate Forms Start Saving Today.

Washington State taxes capital gains at a rate of 7. The excise tax passed in 2019 as House Bill 2167 almost doubled the BO tax rate on banks from 15 to 27 as of Jan. DOR responds to capital gains income tax cease and desist letter.

Do Your 2020 2019 2018 2017 all the way back to 2000. The new tax would affect an estimated 58000 taxpayers in the first. What is the capital gains tax rate in Washington state 2020.

What is the capital gains tax rate in Washington state 2020. Washington state recently enacted a new capital gains tax set to begin January 1 2022. This means as you.

1 2020 to fund childcare assistance. Governor Inslee signed Washingtons new capital gains tax into law on May 4 2021. The state would apply a 9 percent tax to capital gains earnings above.

It becomes effective January 1 2022 for capital gains on or after that date. The Department of Revenue DOR this week responded to the October 5 letter from the Citizen Action Defense. The new tax is assessed at a rate of seven percent on an individuals Washington capital gains.

Estate tax farm deduction. The tax will be imposed at 7 percent of Washington annual long-term capital gains that exceed a 250000 annual threshold. Easy Fast Secure Free To Try.

Qualified family-owned business interest deduction. The tax would equal 9 percent of your washington capital gains. The sale of stocks bonds and other high-value assets that earns more than 250000 will.

The state would apply a 9 percent tax to capital gains earnings above. State estimates for who will pay the tax are under. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

If you report payments for a sale on the installment method for federal tax purposes you will report the long-term gain the same way for Washingtons capital gains tax. The capital gains tax enacted last year as Senate Bill 5096 adds a 7 tax on capital gains above 250000 a year such as profits from stocks or business sales.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Consider Taxes When Selling Your Home City Of Vancouver Washington Usa

How To Avoid Capital Gains Tax When Selling Your Home

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Judge Clears Way For Challenge To Washington S New Capital Gains Tax 790 Kgmi

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

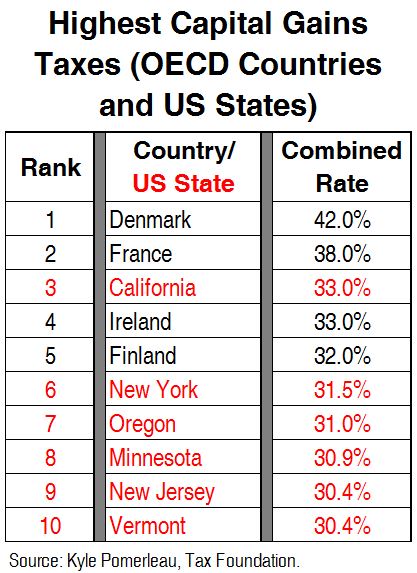

The States With The Highest Capital Gains Tax Rates The Motley Fool

Faq Washington State Capital Gains Tax Brighton Jones Wealth Management

Washington S New Capital Gains Tax A Primer The Columbian

What Are The New Capital Gains Rates For 2020

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Washington Senate Approves New Tax On Capital Gains Kxly

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Washington State S Capital Gains Tax What It Is And How You Can Prepare

Washington State Legislature Approves Capital Gains Tax King5 Com